The Importance of Education in Crypto Investment sets the stage for understanding the vital role of knowledge before venturing into the world of cryptocurrency investments. Get ready to explore the impact of education on financial success in this dynamic market.

The Importance of Education in Crypto Investment

Before jumping into the world of crypto investment, it is crucial to have a solid educational foundation. Understanding the basics of blockchain technology, different types of cryptocurrencies, and market trends can help investors make informed decisions.

Avoiding Significant Financial Losses

Without proper education, investors can easily fall into the trap of scams, Ponzi schemes, or risky investments. Lack of knowledge about how to store and secure digital assets can also result in hacking incidents, leading to substantial financial losses.

Continuous Learning and Staying Updated

In the ever-evolving world of cryptocurrencies, staying up-to-date with the latest news, regulations, and technological advancements is essential. Continuous learning can help investors adapt to market changes, identify new opportunities, and mitigate risks effectively.

Understanding Cryptocurrency Basics

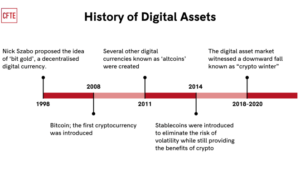

Before diving into the world of crypto investments, it is crucial to have a solid understanding of the fundamental concepts of cryptocurrency.

Types of Cryptocurrencies, The Importance of Education in Crypto Investment

- Bitcoin: Considered the first cryptocurrency, it operates on a decentralized network without a central authority.

- Ethereum: Known for its smart contract functionality, allowing developers to create decentralized applications on its blockchain.

- Ripple: Primarily used for facilitating cross-border payments, with a focus on partnerships with financial institutions.

- Litecoin: Often referred to as the silver to Bitcoin’s gold, it offers faster transaction times and lower fees.

Unique Features of Cryptocurrencies

- Decentralization: Cryptocurrencies are not controlled by any central authority, providing users with more financial autonomy.

- Transparency: All transactions are recorded on a public ledger, ensuring accountability and reducing the risk of fraud.

- Security: Cryptocurrencies utilize cryptographic techniques to secure transactions, making them resistant to hacking.

Importance of Blockchain Technology

Blockchain technology serves as the backbone of cryptocurrencies, allowing for secure and transparent transactions without the need for intermediaries.

Blockchain is a decentralized ledger that records all transactions across a network of computers, ensuring immutability and integrity.

Risk Management in Crypto Investment

Investing in cryptocurrencies can be highly rewarding, but it also comes with significant risks due to the market’s volatility. Implementing effective risk management strategies is crucial to safeguard your investments and maximize returns.

Diversification of Portfolio

Diversifying your crypto portfolio is a key risk management technique. By spreading your investments across different cryptocurrencies, you can reduce the impact of a single asset’s price fluctuations on your overall portfolio. This helps minimize the risk of significant losses if one cryptocurrency underperforms.

Setting Stop-Loss Orders

Setting stop-loss orders is another essential risk management strategy in crypto investment. This allows you to automatically sell a cryptocurrency when its price reaches a predetermined level, helping you limit potential losses. By setting stop-loss orders, you can protect your investment capital from sudden market downturns.

Staying Informed and Educated

Education plays a crucial role in effective risk management in crypto investment. By staying informed about market trends, technological developments, and regulatory changes, investors can make informed decisions and adapt their strategies accordingly. Understanding the underlying factors driving cryptocurrency prices can help investors anticipate market movements and adjust their portfolio allocations to minimize risks.

Identifying Reliable Sources of Information: The Importance Of Education In Crypto Investment

In the world of cryptocurrency investment, it is crucial to gather information from credible and trustworthy sources to make informed decisions and mitigate risks. Reliable sources can provide valuable insights and guidance in navigating the complex crypto landscape.

The Importance of Sourcing Information from Credible Platforms

- Verify the credibility of the platform by checking for reviews, user feedback, and the reputation of the source.

- Look for information from established news outlets, reputable financial websites, and official announcements from blockchain projects.

- Avoid sources that promise unrealistic returns or use sensationalist language to attract investors.

Differentiating Between Reliable Sources and Misinformation

- Double-check facts and cross-reference information from multiple sources to ensure accuracy.

- Beware of sources spreading FUD (fear, uncertainty, doubt) or engaging in pump-and-dump schemes.

- Consult experts in the field or join online communities to verify information and discuss potential red flags.

Building a Network of Experts and Mentors

- Connect with experienced investors, traders, and blockchain professionals to gain insights and learn from their experiences.

- Participate in forums, social media groups, and attend conferences to expand your network and access valuable resources.

- Seek mentorship from seasoned experts who can provide guidance, answer questions, and offer support in your crypto journey.