Kicking off with The Importance of Crypto Adoption for Global Finance, this opening paragraph is designed to captivate and engage the readers, setting the tone for a deep dive into the impact of cryptocurrencies on the global financial system. From changing traditional financial infrastructures to promoting financial inclusion, the world of crypto is reshaping how we view and interact with money on a global scale.

Importance of Crypto Adoption for Global Finance: The Importance Of Crypto Adoption For Global Finance

Cryptocurrency adoption has the potential to revolutionize the global financial system by providing a more efficient, secure, and transparent alternative to traditional banking methods. The adoption of cryptocurrencies can lead to various benefits for the global economy, including increased financial inclusion, reduced transaction costs, and improved accessibility to financial services.

Impact on Global Financial System

- Crypto adoption can facilitate faster and cheaper cross-border transactions, eliminating the need for intermediaries and reducing transfer fees.

- Blockchain technology, the backbone of cryptocurrencies, enables secure and tamper-proof transactions, enhancing trust and accountability in the financial system.

- Decentralized finance (DeFi) platforms powered by cryptocurrencies offer innovative financial services to individuals who are underserved by traditional banks.

Benefits of Integrating Cryptocurrencies, The Importance of Crypto Adoption for Global Finance

- Integration of cryptocurrencies into the traditional financial infrastructure can enhance financial efficiency by streamlining processes and reducing operational costs.

- Cryptocurrencies provide a borderless and permissionless financial ecosystem, allowing individuals to access financial services without geographical restrictions.

- Smart contracts and automated processes enabled by cryptocurrencies can improve transparency and reduce the risk of fraud in financial transactions.

Role in Promoting Financial Inclusion

- Cryptocurrencies enable individuals without access to traditional banking services to participate in the global economy and manage their finances securely.

- Microtransactions made possible by cryptocurrencies can empower individuals in developing countries to engage in economic activities and improve their financial well-being.

- Crypto wallets and digital currencies provide a user-friendly and cost-effective means for people in underserved communities to store and transfer money.

Challenges of Crypto Adoption

Cryptocurrencies have the potential to revolutionize the financial industry, but their widespread adoption faces several key challenges that need to be addressed.

Regulatory Hurdles

The lack of clear regulatory frameworks around cryptocurrencies poses a significant barrier to their adoption in global finance. Different countries have varying approaches to regulating digital assets, leading to uncertainty and risk for businesses and investors. Without consistent and comprehensive regulations, many traditional financial institutions are hesitant to fully embrace cryptocurrencies, limiting their integration into the mainstream financial system.

Security Concerns

Security remains a major concern for the adoption of cryptocurrencies in global finance. The decentralized nature of blockchain technology, while offering transparency and immutability, also makes it susceptible to hacking and fraud. High-profile incidents of exchange hacks and scams have eroded trust in the security of digital assets, deterring many individuals and institutions from entering the crypto market. Addressing these security vulnerabilities and enhancing the protection of users’ funds are crucial steps towards increasing confidence in the use of cryptocurrencies for financial transactions.

Innovation in Financial Technology

Cryptocurrency adoption plays a crucial role in driving innovation in financial technology, revolutionizing traditional systems and paving the way for new solutions. The integration of cryptocurrencies in the financial sector has brought about transformative changes that are reshaping the global financial landscape.

Emergence of Decentralized Finance (DeFi)

- Decentralized Finance, or DeFi, is a prime example of innovative solutions that have emerged from the integration of cryptocurrencies. It leverages blockchain technology to create a decentralized financial ecosystem, allowing users to access various financial services without the need for traditional intermediaries.

- DeFi platforms enable users to borrow, lend, trade, and earn interest on their digital assets, providing financial inclusion to individuals who were previously excluded from traditional banking systems.

- The rise of DeFi has unlocked new opportunities for financial innovation, offering more efficient and cost-effective ways to access and manage financial services.

Impact of Blockchain Technology on Global Financial Systems

- Blockchain technology, the underlying technology behind cryptocurrencies, has the potential to revolutionize global financial systems by enhancing security, transparency, and efficiency.

- Blockchain enables secure and tamper-proof transactions, eliminating the need for intermediaries and reducing the risk of fraud and cyberattacks.

- Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate processes and enable trustless transactions, further streamlining financial operations.

- The adoption of blockchain technology in global financial systems can lead to increased efficiency, reduced costs, and improved accessibility to financial services for individuals worldwide.

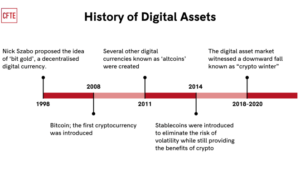

Cryptocurrency Market Trends

Cryptocurrency market trends play a crucial role in shaping the global financial landscape. These trends impact everything from investment decisions to regulatory policies.

Volatility of Cryptocurrencies

- The volatility of cryptocurrencies is a double-edged sword, offering high potential returns but also posing significant risks.

- Extreme price fluctuations can lead to massive gains or losses for investors, making it essential to carefully manage risks.

- Regulators and policymakers are grappling with how to address the challenges posed by the volatility of cryptocurrencies while still fostering innovation in the sector.

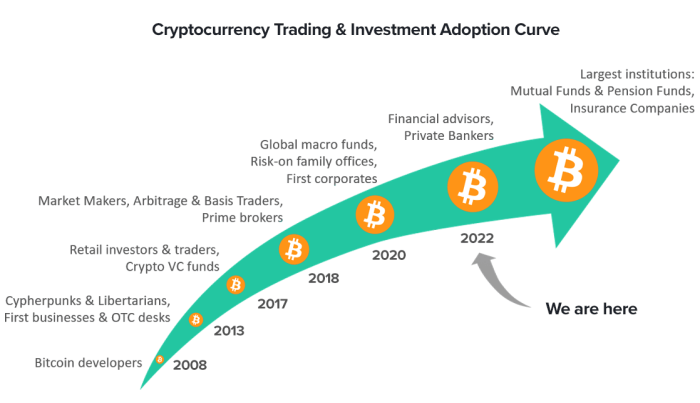

Mainstream Adoption and Market Trends

- The mainstream adoption of cryptocurrencies has a direct impact on market trends, influencing prices and trading volumes.

- As more individuals and institutions embrace cryptocurrencies, the market becomes more liquid and stable, reducing the impact of sudden price swings.

- Increased adoption also attracts more institutional investors and traditional financial players, further legitimizing the crypto market and driving continued growth.