The Challenges of Crypto Regulation sets the stage for a rollercoaster ride through the intricate world of cryptocurrency regulation, shedding light on the hurdles faced by governments, businesses, and consumers alike. Get ready to dive deep into the ever-evolving realm of crypto compliance and innovation!

Overview of Crypto Regulation

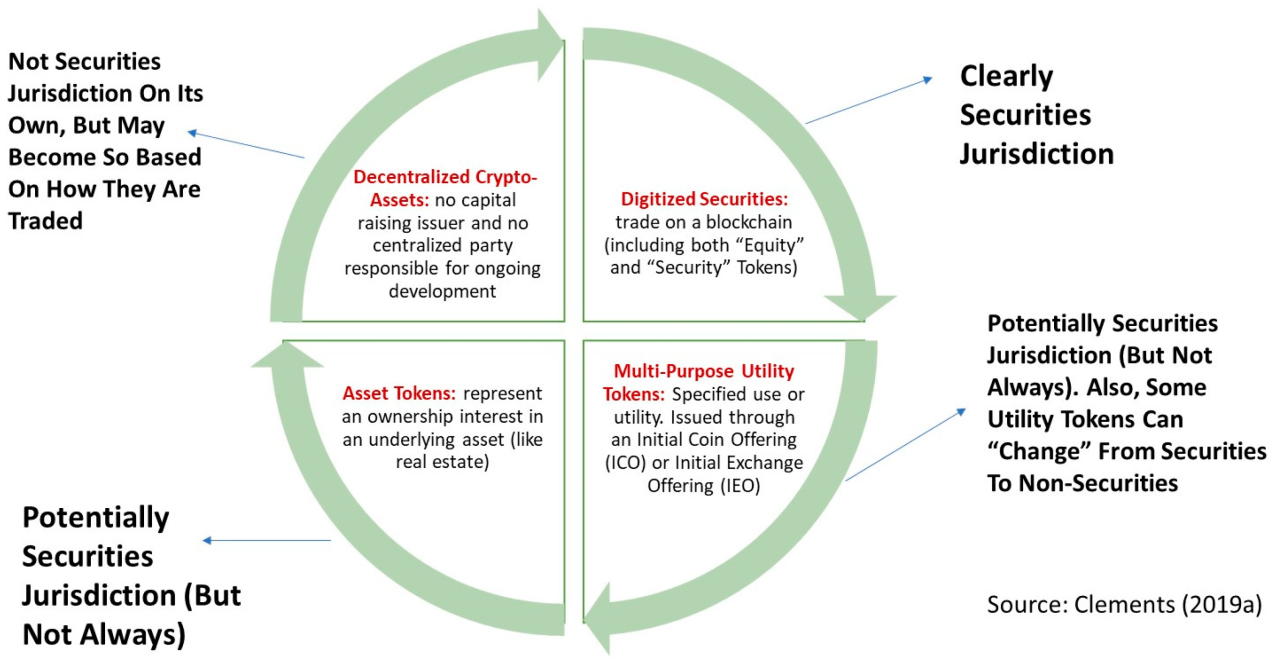

Cryptocurrency regulation refers to the set of rules and policies put in place by governments or regulatory bodies to govern the use and exchange of digital currencies like Bitcoin and Ethereum. The main reason for implementing crypto regulation is to protect investors, prevent illegal activities such as money laundering and fraud, and ensure financial stability in the market.

Key Stakeholders in Crypto Regulation

- Governments: Governments play a crucial role in establishing and enforcing regulations to oversee the cryptocurrency market.

- Financial Institutions: Banks and other financial institutions are involved in complying with crypto regulations to prevent financial crimes.

- Cryptocurrency Exchanges: Platforms where cryptocurrencies are bought, sold, and traded must adhere to regulatory guidelines to operate legally.

- Investors: Individuals and institutional investors are impacted by crypto regulations as they influence the market dynamics and investment decisions.

Challenges of Regulating Cryptocurrencies, The Challenges of Crypto Regulation

- Global Nature: Cryptocurrencies operate across borders, making it challenging for a single government to regulate them effectively.

- Regulatory Gaps: The fast-paced nature of the crypto market often outpaces regulatory frameworks, creating loopholes for illicit activities.

- Technological Complexity: Understanding the intricate blockchain technology behind cryptocurrencies poses a challenge for regulators in crafting appropriate regulations.

- Privacy Concerns: Balancing the privacy of cryptocurrency users with the need to prevent criminal activities is a delicate task for regulators.

Regulatory Landscape

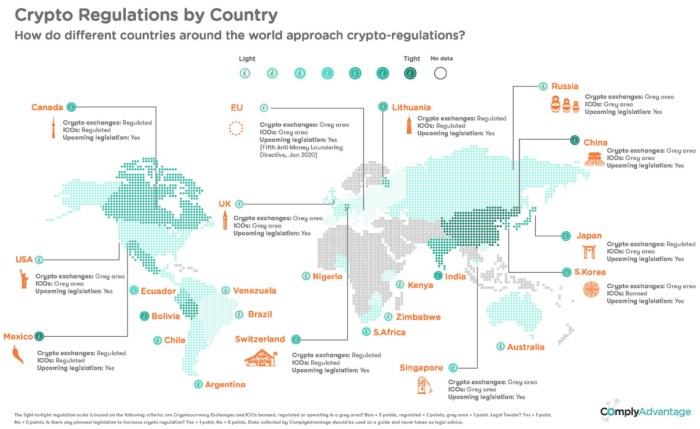

The regulatory landscape for cryptocurrencies varies significantly across the globe, with some countries embracing them, while others impose strict regulations.

Countries like the United States, Japan, and South Korea have implemented strict regulations on cryptocurrencies to prevent fraud, money laundering, and other illegal activities. These regulations often require exchanges to obtain licenses, comply with anti-money laundering (AML) and know your customer (KYC) requirements, and adhere to strict reporting standards. While these regulations aim to protect investors and maintain market integrity, they can also stifle innovation and hinder the growth of the crypto market.

On the other hand, countries like Malta, Switzerland, and Singapore have taken a more lenient approach to regulating cryptocurrencies, creating a more favorable environment for crypto businesses to thrive. These countries have established clear regulatory frameworks that provide certainty and stability for businesses operating in the crypto space, attracting companies from around the world to set up shop in their jurisdictions.

Impact of Strict Regulations on the Market

Strict regulations in countries like the United States and Japan have had a significant impact on the crypto market. While these regulations help protect investors and weed out bad actors, they can also deter new entrants from entering the market due to compliance costs and regulatory uncertainty. This can lead to a lack of innovation and slower growth in the crypto industry.

In contrast, countries with more favorable regulatory environments, such as Malta and Switzerland, have seen a boom in crypto-related businesses setting up shop in their jurisdictions. The clear and predictable regulatory frameworks in these countries have attracted companies looking for stability and certainty, leading to increased investment and innovation in the crypto space.

Overall, the regulatory landscape for cryptocurrencies is complex and constantly evolving, with each country taking its own approach to regulating this emerging asset class. Finding the right balance between protecting investors and fostering innovation is crucial to ensuring the long-term success of the crypto industry.

Compliance Issues

Cryptocurrency exchanges and businesses face numerous compliance challenges due to the rapidly evolving regulatory landscape. Ensuring adherence to these regulations is crucial for maintaining legality and trust within the industry.

Challenges Faced

- Lack of Clarity: Regulations surrounding cryptocurrencies are often vague and subject to interpretation, making it difficult for businesses to ensure full compliance.

- AML/KYC Requirements: Implementing robust anti-money laundering (AML) and know your customer (KYC) processes can be costly and time-consuming for businesses.

- Data Privacy Concerns: Handling sensitive customer information in compliance with data privacy laws adds another layer of complexity to regulatory compliance.

Implications of Non-Compliance

- Legal Consequences: Non-compliance with crypto regulations can result in hefty fines, legal action, or even shutdown of operations for businesses.

- Reputation Damage: Failing to adhere to regulations can lead to loss of customer trust and damage the reputation of the business in the industry.

- Lack of Market Access: Non-compliant businesses may face restrictions or bans from operating in certain jurisdictions, limiting their market reach.

Strategies for Ensuring Compliance

- Regular Compliance Audits: Conducting internal audits to ensure adherence to regulations and promptly address any compliance issues that arise.

- Engagement with Regulators: Maintaining open communication with regulatory bodies to stay updated on changes and seek guidance on compliance requirements.

- Investing in Compliance Technology: Utilizing advanced compliance tools and software to streamline AML/KYC processes and data privacy compliance.

Impact on Innovation: The Challenges Of Crypto Regulation

In the rapidly evolving world of blockchain and cryptocurrency, regulatory constraints can have a significant impact on the pace of innovation and development in the industry. Let’s delve into how stringent crypto regulations can influence innovation and explore potential solutions to foster a balance between regulatory compliance and progress.

Stifling Innovation

When regulations become too stringent, it can create barriers for new and innovative projects to enter the market. Startups and entrepreneurs may be deterred from pursuing their ideas due to the complex and costly compliance requirements imposed by regulators. This stifling effect can slow down the overall growth and advancement of the industry.

Examples of Affected Projects

- Project A: A decentralized finance (DeFi) platform had to halt its operations due to regulatory uncertainty surrounding its token offerings.

- Project B: An innovative blockchain-based voting system faced legal challenges in multiple jurisdictions, limiting its expansion and adoption.

Fostering Innovation Responsibly

One approach to balancing regulatory compliance with innovation is to establish clear guidelines and frameworks that provide certainty for projects while ensuring consumer protection and market integrity. Regulators can work closely with industry stakeholders to create a conducive environment for innovation without compromising on compliance.

Consumer Protection

In the realm of crypto regulation, ensuring consumer protection is of utmost importance to safeguard investors and users in the volatile and sometimes risky crypto market. Without proper regulations in place, consumers are vulnerable to various risks and scams that could result in financial losses.

Common Risks Faced by Cryptocurrency Investors

- Market Manipulation: Lack of oversight can lead to price manipulation by large players in the market, impacting smaller investors.

- Security Breaches: Exchanges and wallets are vulnerable to hacking, resulting in the loss of funds for investors.

- Fraudulent ICOs: Initial Coin Offerings (ICOs) may be used as a guise for fraudulent schemes, deceiving investors.

- Lack of Accountability: Without regulations, companies may engage in deceptive practices with no repercussions.

Enhancing Consumer Protection Through Regulatory Frameworks

Regulatory frameworks can establish standards for transparency, security, and accountability within the crypto market, protecting consumers from potential risks.

- Licensing Requirements: Regulators can mandate licenses for exchanges and other crypto-related businesses to ensure they meet certain standards.

- Disclosure Rules: Requiring companies to provide clear and accurate information to investors can help prevent misleading practices.

- Enforcement Mechanisms: Implementing enforcement mechanisms can deter fraudulent activities and hold bad actors accountable.

- Consumer Education: Educating consumers about the risks and best practices in the crypto market can empower them to make informed decisions.

International Cooperation

International cooperation plays a crucial role in regulating cryptocurrencies due to their borderless nature and the challenges they pose to traditional regulatory frameworks.

Challenges and Benefits

One of the main challenges of international cooperation in regulating cryptocurrencies is the differing regulatory approaches and priorities of various countries. This can lead to conflicts and inconsistencies in the regulatory landscape, making it difficult to effectively monitor and control crypto-related activities. However, international cooperation also offers benefits such as sharing of best practices, expertise, and resources to enhance regulatory efforts.

Cross-Border Transactions

The decentralized nature of cryptocurrencies enables cross-border transactions without the need for intermediaries, making it challenging for regulators to track and monitor these transactions. This poses a significant obstacle to enforcing regulatory measures and combating illegal activities such as money laundering and terrorist financing.

Successful Collaborations

Some countries have successfully collaborated to address crypto-related challenges. For example, the Financial Action Task Force (FATF) has developed international standards and recommendations for combating money laundering and terrorist financing in the crypto space. Additionally, the European Union has taken steps to harmonize crypto regulations across member states to create a more consistent regulatory environment.