Latest Developments in the Crypto World dives deep into the ever-evolving landscape of cryptocurrency, exploring the newest trends, regulations, and innovations that are shaping the industry. Get ready to ride the wave of digital currency revolution!

From new cryptocurrencies to regulatory changes, this overview will keep you in the loop on all things crypto. So, grab your virtual wallet and let’s explore the exciting world of decentralized finance together.

Latest Trends in Cryptocurrency: Latest Developments In The Crypto World

Cryptocurrency trends are constantly evolving, reflecting the dynamic nature of the industry. These trends have a significant impact on how cryptocurrencies are perceived, utilized, and traded in the market. Let’s explore some of the latest trends and see how they are shaping the crypto world.

DeFi Dominance

Decentralized Finance (DeFi) has been a major trend in the crypto space, with platforms offering various financial services without the need for traditional intermediaries. The rise of DeFi protocols has provided users with opportunities for lending, borrowing, and earning interest, revolutionizing the way people interact with financial services.

NFT Craze

Non-Fungible Tokens (NFTs) have gained immense popularity, creating a new market for digital art, collectibles, and other unique assets. The NFT craze has brought mainstream attention to the concept of digital ownership and scarcity, with artists and creators leveraging blockchain technology to tokenize their work.

Sustainability Concerns, Latest Developments in the Crypto World

As the environmental impact of cryptocurrency mining comes under scrutiny, there is a growing focus on sustainability in the industry. With concerns about the carbon footprint of mining operations, initiatives are being developed to promote eco-friendly practices and reduce energy consumption in crypto mining.

Regulatory Developments

Regulatory frameworks around the world are constantly evolving to address the challenges posed by cryptocurrencies. Governments and regulatory bodies are working to establish guidelines for the use of digital assets, aiming to ensure investor protection, prevent financial crimes, and promote market integrity.

Institutional Adoption

Institutional interest in cryptocurrencies continues to grow, with more traditional financial institutions and corporations entering the market. The involvement of institutional players has brought greater liquidity, stability, and credibility to the crypto space, signaling a shift towards mainstream acceptance.

New Cryptocurrencies and ICOs

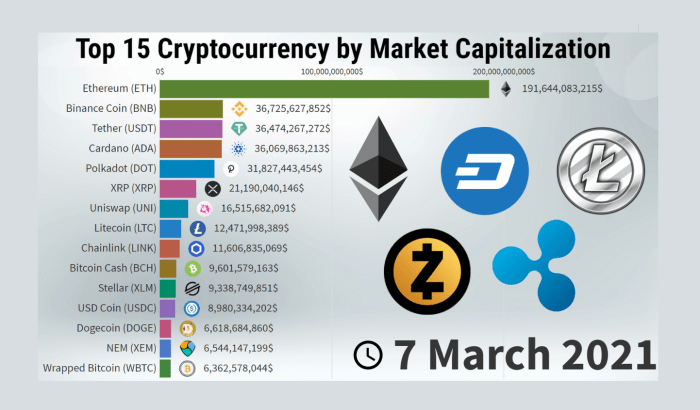

In the fast-paced world of cryptocurrencies, new digital assets are constantly being launched, offering innovative solutions to various problems and creating new investment opportunities.

Initial Coin Offerings (ICOs) are fundraising events where new cryptocurrencies or tokens are sold to early investors in exchange for traditional currency or other established cryptocurrencies. ICOs have played a significant role in the crypto space, allowing startups to raise funds quickly and efficiently without the need for traditional venture capital.

Latest Cryptocurrencies

- 1. Solana (SOL): A high-performance blockchain platform known for its fast transaction speeds and low fees.

- 2. Avalanche (AVAX): A platform designed for building decentralized applications and custom blockchain networks.

- 3. Polkadot (DOT): A multi-chain network that enables different blockchains to transfer messages and value in a secure and trust-free fashion.

Most Promising ICO Projects

- 1. Elrond (EGLD): A scalable blockchain platform that aims to provide fast and secure transactions for decentralized applications.

- 2. Near Protocol (NEAR): A developer-friendly blockchain platform focused on usability and scalability for mainstream adoption.

- 3. Origin Protocol (OGN): A decentralized marketplace platform that enables buyers and sellers to interact without intermediaries.

Regulatory Changes Impacting Cryptocurrencies

Recently, there have been significant regulatory developments impacting the world of cryptocurrencies. These changes are shaping the market and influencing investor sentiment in various ways.

Impact on Market Dynamics

New regulations are causing fluctuations in the crypto market as investors react to the changing landscape. This uncertainty can lead to increased volatility and sudden price movements.

Investor Sentiment

Investors are closely monitoring regulatory changes to gauge the future of cryptocurrencies. Unclear regulations can create doubt and hesitation among investors, impacting their decisions and overall sentiment towards the market.

Long-Term Effects

The long-term effects of regulatory changes on the crypto industry are still unfolding. It is crucial to analyze how these regulations will shape the future of cryptocurrencies, potentially leading to more stable markets or hindering innovation and growth.

Innovations in Blockchain Technology

Blockchain technology continues to evolve rapidly, bringing forth new advancements that have the potential to revolutionize various industries. These innovations are not only reshaping the way transactions are conducted but also opening up possibilities for increased efficiency, transparency, and security.

Decentralized Finance (DeFi)

- Decentralized Finance, or DeFi, is a fast-growing sector within the blockchain space that aims to recreate traditional financial systems using decentralized technologies.

- DeFi applications allow users to access financial services such as lending, borrowing, and trading without the need for intermediaries like banks.

- Smart contracts play a crucial role in DeFi platforms, automating processes and ensuring the security and transparency of transactions.

Non-Fungible Tokens (NFTs)

- Non-Fungible Tokens, or NFTs, are unique digital assets that are indivisible and cannot be replicated, making them one-of-a-kind collectibles.

- NFTs are being used in various industries, including art, gaming, and real estate, to tokenize and trade digital assets securely on the blockchain.

- The use of NFTs has opened up new revenue streams for creators and artists, allowing them to monetize their work in innovative ways.

Interoperability Solutions

- Interoperability solutions aim to address the issue of blockchain networks operating in isolation by enabling seamless communication and data transfer between different blockchains.

- Projects like Polkadot and Cosmos are working on interoperability protocols that allow for the exchange of assets and information across multiple blockchains.

- Interoperability solutions have the potential to enhance scalability, reduce transaction costs, and foster collaboration among diverse blockchain ecosystems.