Kicking off with How to Avoid Crypto Investment Fraud, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

In the world of crypto investments, where fortunes can be made and lost in the blink of an eye, it’s essential to stay vigilant against fraud. From conducting due diligence to recognizing common scams, securing your assets, and verifying project legitimacy, this guide will equip you with the knowledge to navigate the crypto space safely. Get ready to level up your crypto game and protect your hard-earned cash like a boss!

Importance of Due Diligence in Crypto Investments: How To Avoid Crypto Investment Fraud

Investing in cryptocurrencies can be a lucrative opportunity, but it also comes with risks. That’s why conducting due diligence before making any investment decisions is crucial to avoid falling victim to fraud or scams in the crypto space.

Steps for Performing Due Diligence

- Evaluate the team behind the project: Look into the background and experience of the project’s team members. A reputable and experienced team is more likely to deliver on their promises.

- Review the project’s whitepaper: The whitepaper provides detailed information about the project’s goals, technology, and roadmap. Make sure it is well-written and transparent.

- Check for a working product or prototype: A project with a working product or prototype is more likely to succeed than one that is just an idea on paper.

- Research the project’s community and reputation: Look for feedback from other investors, reviews on social media, and the overall reputation of the project within the crypto community.

Red Flags to Watch Out For

- Unrealistic promises of high returns with little to no risk: If an investment opportunity sounds too good to be true, it probably is.

- Lack of transparency or vague information about the project: Projects that are not transparent about their goals, technology, or team members may be hiding something.

- Poor communication and responsiveness from the team: A reputable project should have clear communication channels and be responsive to investor inquiries.

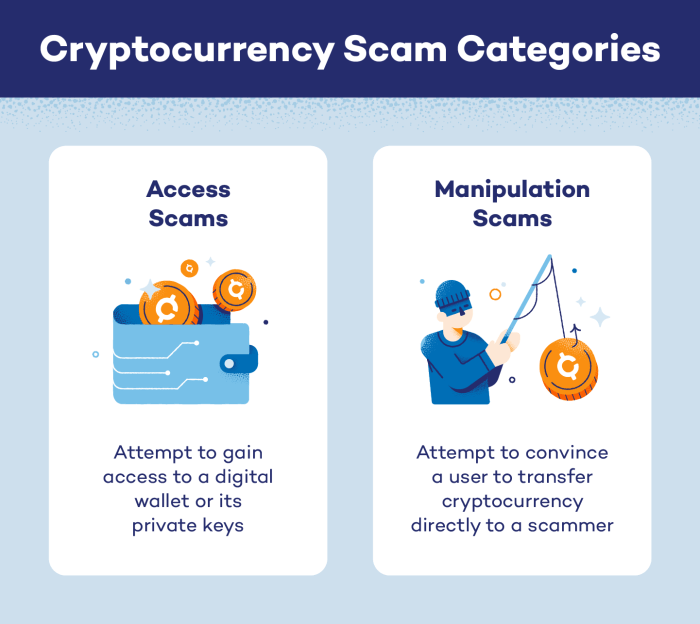

Recognizing Common Crypto Investment Scams

Cryptocurrency investment scams are unfortunately prevalent in the industry, targeting unsuspecting investors looking to capitalize on the booming market. These scams can take various forms and often rely on deception and manipulation to defraud individuals of their hard-earned money.

Ponzi Schemes

Ponzi schemes are one of the most common types of scams in the crypto investment space. In a Ponzi scheme, scammers promise high returns on investment to attract new investors. However, instead of generating legitimate profits, the scammers use the money from new investors to pay returns to earlier investors. This cycle continues until the scheme collapses, leaving many investors with significant losses.

Phishing Scams

Phishing scams involve fraudsters creating fake websites or emails that mimic legitimate cryptocurrency platforms or exchanges. These fake sites are designed to trick investors into providing their personal information, such as login credentials or wallet addresses. Once scammers have this information, they can access investors’ funds and steal their cryptocurrency holdings.

Fake ICOs, How to Avoid Crypto Investment Fraud

Initial Coin Offerings (ICOs) are a popular way for cryptocurrency projects to raise funds. However, scammers have taken advantage of this by creating fake ICOs to lure investors with promises of revolutionary technology and high returns. Once investors contribute their funds to these fake ICOs, the scammers disappear with the money, leaving investors with worthless tokens.

Impersonation Scams

Impersonation scams involve scammers posing as well-known figures in the cryptocurrency industry, such as influencers, executives, or celebrities. These scammers use fake social media accounts or emails to deceive investors into sending them cryptocurrency or providing sensitive information. By exploiting the trust and reputation of these figures, scammers can easily deceive unsuspecting investors.

Exit Scams

Exit scams occur when cryptocurrency projects or exchanges suddenly shut down without warning, taking investors’ funds with them. These scams often involve promises of high returns or innovative products, only to disappear once a significant amount of funds has been collected. Investors are left with no recourse to recover their investments, as the scammers behind the exit scam are nowhere to be found.

Securing Your Crypto Assets

When it comes to safeguarding your cryptocurrency holdings, taking the necessary precautions is crucial to prevent any potential security breaches or loss of funds.

Types of Cryptocurrency Wallets and Security Features

- Hardware Wallets: These physical devices store your private keys offline, making them highly secure against hacking attempts.

- Software Wallets: These are digital wallets that can be accessed through desktop or mobile applications. While convenient, they may be more susceptible to cyber attacks.

- Paper Wallets: A paper wallet is a physical document containing your public and private keys, offering an offline storage option with minimal risk of online threats.

Tips for Enhancing Security

- Always create strong and unique passwords for your crypto accounts, combining letters, numbers, and special characters.

- Enable two-factor authentication (2FA) wherever possible to add an extra layer of security to your accounts.

- Avoid sharing your private keys or sensitive information with anyone, as this could lead to unauthorized access to your funds.

- Regularly update your wallet software and ensure you are using the latest versions to patch any security vulnerabilities.

Verifying Legitimacy of Crypto Projects

When considering investing in a crypto project, it is essential to verify its legitimacy to avoid falling victim to scams. By conducting thorough research and due diligence, you can protect your investments and make informed decisions.

Researching the Team Behind the Project

Before investing in a crypto project, it is crucial to research the team behind it. Look into the team members’ backgrounds, experience, and qualifications. Verify their identities and check if they have a track record of successful projects in the crypto space. A reputable and experienced team increases the project’s credibility and reduces the risk of potential scams.

Evaluating the Whitepaper

The whitepaper is a crucial document that Artikels the project’s goals, technology, and roadmap. Analyze the whitepaper to understand the project’s purpose, use case, and potential for growth. Look for detailed information on the project’s technology, tokenomics, and implementation strategy. A well-written and transparent whitepaper is a sign of a legitimate project.

Considering Community Feedback

Community feedback plays a significant role in verifying the legitimacy of a crypto project. Engage with the project’s community through social media channels, forums, and discussion groups. Look for reviews, testimonials, and opinions from other investors and industry experts. Positive feedback and active community engagement are indicators of a trustworthy project.

Distinguishing Genuine Projects from Scams

It is essential to be able to distinguish between genuine projects and potential scams in the crypto space. Watch out for red flags such as promises of guaranteed returns, lack of transparency, and unrealistic claims. Conduct thorough research, trust your instincts, and seek advice from reputable sources to avoid falling for fraudulent schemes.