Kicking off with How Crypto Can Help With Financial Inclusion, this topic dives into how cryptocurrency is revolutionizing financial services with its innovative approach, offering a glimpse into a future where everyone has access to financial resources and opportunities.

Importance of Financial Inclusion: How Crypto Can Help With Financial Inclusion

Financial inclusion refers to the availability and accessibility of financial services to all individuals and businesses, regardless of their income levels. It aims to ensure that everyone has access to banking, credit, insurance, and other financial products and services.

Crucial for Economic Growth

Financial inclusion plays a vital role in promoting economic growth and development. When individuals and communities have access to financial services, they can save, invest, and borrow money to start businesses or improve their living standards. This, in turn, leads to increased economic activity, job creation, and poverty reduction.

Impact of Financial Exclusion

On the flip side, financial exclusion can have severe consequences for individuals and communities. Without access to basic financial services, people are forced to rely on informal and often predatory lending sources, leading to a cycle of debt and financial instability. Moreover, financial exclusion can hinder economic growth by limiting the ability of individuals to participate in the formal economy and take advantage of opportunities for wealth creation.

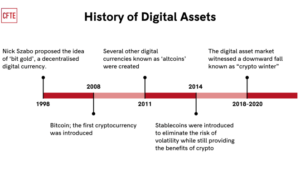

Overview of Cryptocurrency

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central authority, such as a government or financial institution.

How Cryptocurrency Works as a Digital Currency

Cryptocurrency transactions are recorded on a decentralized digital ledger called a blockchain. Each transaction is verified by a network of computers, known as miners, to ensure its accuracy and security. This decentralized nature eliminates the need for intermediaries like banks, resulting in faster and more cost-effective transactions.

Benefits of Using Cryptocurrency

- Security: Cryptocurrency transactions are secure and anonymous due to the use of cryptographic techniques.

- Accessibility: Cryptocurrency can be accessed by anyone with an internet connection, making it ideal for individuals who are unbanked or underbanked.

- Lower transaction fees: Cryptocurrency transactions typically have lower fees compared to traditional banking systems.

- Global reach: Cryptocurrency transcends geographical boundaries, allowing for cross-border transactions without the need for currency conversion.

- Financial inclusion: Cryptocurrency can help bridge the gap for individuals who lack access to traditional banking services, promoting financial inclusion.

Role of Crypto in Financial Inclusion

Cryptocurrency has the potential to revolutionize financial inclusion by providing access to financial services for the unbanked population and underserved communities.

Bridging the Gap for the Unbanked Population

- Cryptocurrency can offer an alternative to traditional banking systems, allowing individuals without access to banks to participate in financial transactions.

- By using blockchain technology, crypto eliminates the need for intermediaries, making financial services more affordable and accessible.

- Projects like BitPesa in Africa are enabling cross-border payments and remittances for those without traditional banking accounts.

Providing Financial Services to Underserved Communities

- Crypto can empower marginalized communities by offering them a secure and efficient way to save, invest, and transact without relying on traditional banks.

- Initiatives like Kiva are leveraging blockchain technology to provide microloans to entrepreneurs in developing countries, fostering economic growth and financial empowerment.

- Blockchain-based platforms like Stellar are facilitating low-cost and instant cross-border transactions, benefiting individuals in regions with limited banking infrastructure.

Accessibility and Affordability

Cryptocurrency has the potential to revolutionize financial services by making them more accessible to marginalized groups. With traditional banking systems often excluding those without proper documentation or living in remote areas, crypto offers a decentralized and borderless alternative.

Increased Access to Financial Services, How Crypto Can Help With Financial Inclusion

- Individuals without access to traditional banks can use cryptocurrencies to store, send, and receive money without the need for a physical bank account.

- Blockchain technology allows for financial transactions to be conducted securely and transparently, enabling those in underserved regions to participate in the global economy.

Cost-Effectiveness of Crypto Transactions

- Using cryptocurrency for transactions and remittances can be more cost-effective compared to traditional banking systems that charge high fees, especially for cross-border transactions.

- Crypto transactions can be processed quickly and efficiently, reducing the time and costs associated with traditional banking processes.

Success Stories in Underserved Regions

- In countries with unstable economies or limited access to banking services, individuals have been able to use cryptocurrency to protect their wealth and engage in online commerce.

- Remittance recipients in developing countries have benefited from lower transaction fees and faster transfer times when receiving funds in cryptocurrency.

Security and Transparency

Cryptocurrency transactions are secured through blockchain technology, which is essentially a decentralized and immutable ledger. Each transaction is recorded in a block, linked to the previous one, making it nearly impossible to alter or tamper with the data. This high level of security ensures that transactions are safe from hacking or fraudulent activities.

Blockchain Transparency

- Blockchain technology provides full transparency in financial transactions by allowing anyone to view the transaction history on a public ledger. This transparency reduces the risk of corruption or manipulation.

- Compared to traditional banking systems where transactions are often hidden from the public, blockchain offers a level of openness that builds trust among users.

Preventing Fraud and Enhancing Trust

- Cryptocurrency can prevent fraud through its decentralized nature, eliminating the need for intermediaries that can be susceptible to corruption or fraud.

- Smart contracts, a feature of blockchain technology, automatically execute transactions when specific conditions are met, reducing the risk of human error or malicious intent.

- Examples like the use of blockchain in supply chain management have shown how crypto can enhance trust by providing a transparent and traceable record of transactions.