Kicking off with Can Crypto Replace Fiat Currency, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

Cryptocurrency and fiat currency have been at the center of financial debates, with each having its own pros and cons. Let’s dive into the world of digital and traditional money to see if crypto has what it takes to replace fiat currency.

Can Crypto Replace Fiat Currency

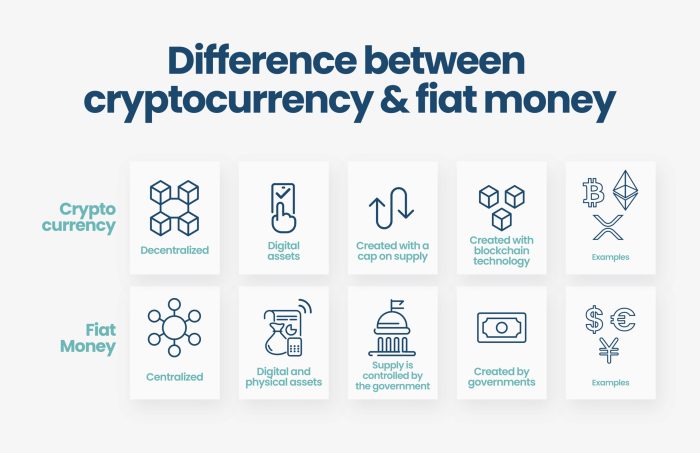

Cryptocurrency and fiat currency are two different forms of money that serve as mediums of exchange. Cryptocurrency is a digital or virtual form of currency that uses cryptography for security, while fiat currency is issued by governments and regulated by central banks.

Popular Cryptocurrencies and Fiat Currencies

- Popular cryptocurrencies include Bitcoin, Ethereum, and Ripple.

- Popular fiat currencies include the US Dollar, Euro, and Japanese Yen.

Advantages of Cryptocurrency

- Decentralization: Cryptocurrencies are not controlled by any central authority or government.

- Security: Cryptocurrency transactions are secure and protected by cryptography.

- Global Accessibility: Cryptocurrencies can be used for international transactions without currency conversion fees.

Disadvantages of Cryptocurrency

- Volatility: Cryptocurrency prices can be highly volatile, leading to uncertain value.

- Regulatory Challenges: Cryptocurrencies may face regulatory scrutiny and restrictions in some countries.

- Lack of Acceptance: Not all merchants and businesses accept cryptocurrencies as a form of payment.

Advantages of Fiat Currency

- Stability: Fiat currencies are generally more stable in value compared to cryptocurrencies.

- Legal Tender: Fiat currencies are accepted as legal tender for payments of debts and goods/services.

- Government Backing: Fiat currencies are backed by governments and central banks, providing a level of trust.

Disadvantages of Fiat Currency

- Inflation: Fiat currencies can be subject to inflation due to government policies.

- Centralized Control: Fiat currencies are controlled by central banks and governments, leading to potential manipulation.

- Transaction Fees: International transactions using fiat currencies may incur high fees for currency conversion.

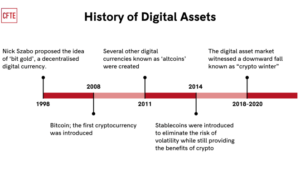

History of Cryptocurrency and Fiat Currency: Can Crypto Replace Fiat Currency

Cryptocurrency and fiat currency have distinct histories that have shaped the way we exchange value in today’s world. Let’s delve into the origins and evolution of these two types of currency and how they have coexisted over time.

Origins and Evolution of Cryptocurrency, Can Crypto Replace Fiat Currency

Cryptocurrency emerged with the creation of Bitcoin in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. This digital currency was designed to operate independently of a central authority, using blockchain technology to secure transactions and create new units of currency. Since then, thousands of alternative cryptocurrencies have been developed, each with its own unique features and use cases.

History of Fiat Currency

Fiat currency has a long history dating back to ancient civilizations where tokens or coins were used as a medium of exchange. However, modern fiat currency as we know it today began to take shape in the 17th century when governments started issuing paper money backed by the state. This type of currency derives its value from the trust and confidence people have in the government that issues it, rather than being backed by a physical commodity like gold or silver.

Coexistence and Influence

Cryptocurrency and fiat currency have coexisted and influenced each other in various ways. While fiat currency remains the dominant form of money in most economies, cryptocurrencies have gained popularity as an alternative and decentralized form of payment. The rise of cryptocurrencies has also spurred innovation in the financial sector, leading to the development of new technologies and financial products. As the two types of currency continue to evolve, their interplay will shape the future of finance and global commerce.

Technology Behind Crypto and Fiat

Cryptocurrencies like Bitcoin are powered by a technology called blockchain. This decentralized digital ledger records all transactions across a network of computers, ensuring transparency and security.

Blockchain Technology in Cryptocurrencies

- Blockchain technology relies on cryptographic principles to secure transactions.

- Each block in the chain contains a unique hash, linking it to the previous block.

- Transactions are verified by network participants through a process called mining.

- Blockchain eliminates the need for intermediaries, reducing transaction costs and increasing efficiency.

Centralized Banking Systems in Fiat Currency

- Fiat currency operates within centralized banking systems controlled by governments and financial institutions.

- Transactions are processed and validated by banks, which act as intermediaries in the system.

- Centralized systems are vulnerable to fraud, hacking, and manipulation due to a single point of control.

- Regulations and policies can impact the speed and cost of transactions in fiat currency.

Impact on Security and Efficiency

- Cryptocurrencies offer enhanced security through decentralization and encryption, making them less susceptible to fraud.

- Blockchain technology ensures transparency and immutability of transaction records, reducing the risk of tampering.

- On the other hand, centralized banking systems may face security breaches and data vulnerabilities due to their centralized nature.

- Efficiency in transactions is typically higher in cryptocurrencies, as they operate 24/7 without delays or restrictions imposed by intermediaries.

Adoption and Regulation of Crypto and Fiat

Cryptocurrencies have seen a significant increase in adoption globally over the past few years. From individuals looking for alternative investment options to businesses incorporating digital currencies into their payment systems, the use of cryptocurrencies continues to grow.

Global Adoption of Cryptocurrencies

- Bitcoin, the first and most popular cryptocurrency, has gained widespread acceptance around the world.

- Many countries are now exploring the use of central bank digital currencies (CBDCs) as a way to modernize their financial systems.

- Cryptocurrency exchanges and wallets are becoming more user-friendly, making it easier for people to buy, sell, and store digital assets.

Government Regulations on Crypto and Fiat

- Government regulations on cryptocurrencies vary greatly from country to country, with some embracing digital assets and others imposing strict restrictions.

- Regulations surrounding fiat currency are more standardized and established, with central banks overseeing the issuance and circulation of traditional money.

- Concerns about money laundering, tax evasion, and consumer protection have led many governments to implement regulations on the use of cryptocurrencies.

Impact of Regulations on Stability and Acceptance

- Regulations can impact the stability of both cryptocurrencies and fiat currency by influencing investor confidence and market behavior.

- Strict regulations on cryptocurrencies may hinder their adoption and limit their use in mainstream financial transactions.

- On the other hand, regulations on fiat currency help maintain stability in the economy and ensure the proper functioning of financial systems.