Kicking off with How Blockchain Can Improve Transparency in Finance, this opening paragraph is designed to captivate and engage the readers, setting the tone American high school hip style that unfolds with each word.

Blockchain technology has revolutionized various industries, and its impact on finance is no exception. From ensuring trust in financial transactions to streamlining processes, the potential of blockchain is immense. Let’s dive into how this innovative technology can enhance transparency in the financial sector.

Importance of Transparency in Finance: How Blockchain Can Improve Transparency In Finance

Transparency plays a crucial role in financial transactions as it ensures accountability, integrity, and trust within the system. Without transparency, there is a higher risk of financial fraud, mismanagement, and unethical practices that can have detrimental effects on individuals, companies, and the overall economy.

Examples of Lack of Transparency Leading to Financial Fraud

- Enron Scandal: Enron, once a leading energy company, engaged in accounting fraud by manipulating financial statements to deceive investors, leading to bankruptcy and massive losses.

- Ponzi Schemes: Schemes like the Madoff investment scandal involved lack of transparency where investors were promised high returns but the money was used to pay off earlier investors, ultimately collapsing and causing significant financial losses.

- Subprime Mortgage Crisis: Lack of transparency in the mortgage industry, with complex financial instruments and misleading practices, contributed to the 2008 financial crisis, resulting in a global recession.

Impact of Transparency on Building Trust in Financial Institutions

Transparency is essential for building trust in financial institutions as it provides clarity on how funds are managed, investments are made, and risks are assessed. When individuals and organizations can access accurate and timely information, they are more likely to have confidence in the financial system, leading to increased investments, stability, and economic growth.

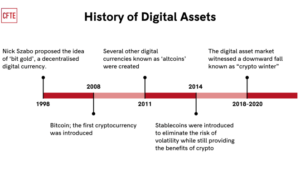

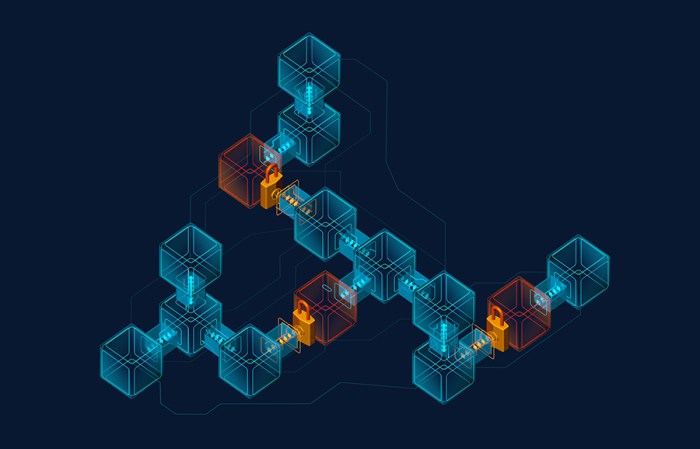

Overview of Blockchain Technology

Blockchain technology is a decentralized and distributed ledger system that allows for secure and transparent transactions without the need for intermediaries. Each block in the chain contains a list of transactions, and once a block is added, it cannot be altered, ensuring the integrity of the data.

Decentralization in Blockchain

Decentralization in blockchain refers to the lack of a central authority controlling the network. Instead, transactions are verified by a network of nodes, each maintaining a copy of the ledger. This eliminates the need for trust in a single entity and reduces the risk of fraud or manipulation.

Role of Cryptographic Algorithms

Cryptographic algorithms play a crucial role in securing blockchain transactions. They are used to encrypt data, create digital signatures, and ensure the authenticity and confidentiality of information. By using cryptographic techniques, blockchain technology can provide a high level of security and privacy for users.

Blockchain Applications in Finance

Blockchain technology has the potential to revolutionize various aspects of the financial industry by enhancing transparency, security, and efficiency. Let’s explore how blockchain can be applied in finance to improve processes and increase trust.

Enhancing Transparency in Financial Transactions

Blockchain technology enables the creation of a decentralized and immutable ledger that records all transactions in real-time. This transparency eliminates the need for intermediaries and provides a secure and efficient way to track financial activities. With blockchain, all parties involved in a transaction can access the same information, ensuring trust and reducing the risk of fraud.

- Blockchain can enhance transparency in cross-border transactions by providing a secure and tamper-proof record of all transactions.

- Smart contracts on the blockchain can automate compliance processes, ensuring that all parties adhere to the agreed-upon terms.

- Real-time auditing of financial transactions is possible with blockchain, allowing for instant verification and validation of data.

Real-time Auditing of Financial Transactions

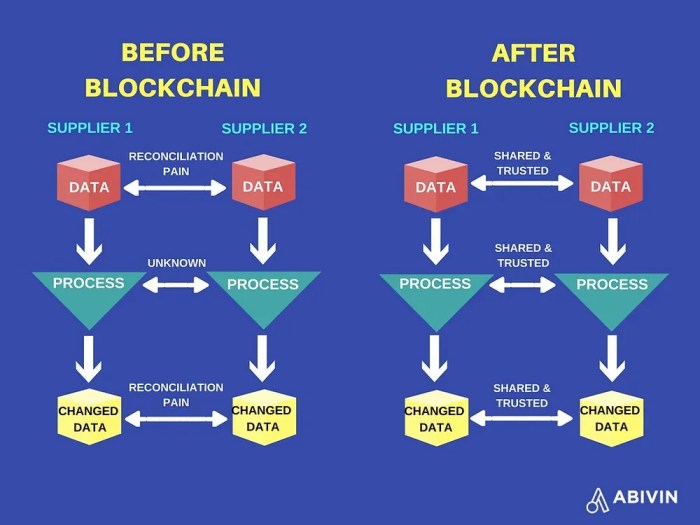

Blockchain technology enables real-time auditing of financial transactions by providing a transparent and tamper-proof record of all activities. The decentralized nature of blockchain eliminates the need for manual reconciliation and auditing processes, saving time and reducing the risk of errors.

Blockchain technology allows for instant verification and validation of financial transactions, ensuring accuracy and transparency.

Automating Financial Processes with Smart Contracts, How Blockchain Can Improve Transparency in Finance

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts can automate and streamline various financial processes, reducing the need for intermediaries and increasing efficiency.

- Smart contracts can automate payment processes, ensuring timely and accurate transactions.

- Blockchain-based smart contracts can streamline loan approval processes by automatically verifying and validating borrower information.

- By using smart contracts, financial institutions can reduce operational costs and improve overall efficiency.

Benefits of Blockchain for Transparency

Blockchain technology offers numerous benefits for transparency in finance. One of the key advantages is its ability to provide an immutable record of financial transactions, ensuring that all data is secure and cannot be altered or tampered with.

Immutable Record of Financial Transactions

Blockchain technology creates a decentralized ledger where all transactions are recorded in a secure and transparent manner. Each transaction is verified by network participants and added to a block, which is then linked to the previous blocks, forming a chain of blocks – hence the name blockchain. This ensures that all financial transactions are securely recorded and cannot be changed retroactively, providing a high level of transparency and trust in the system.

Elimination of Intermediaries in Financial Transactions

Traditionally, financial transactions involve intermediaries such as banks, payment processors, or clearinghouses to facilitate and verify transactions. With blockchain technology, these intermediaries can be eliminated, as transactions are directly recorded on the blockchain network and verified by network participants. This not only reduces the time and cost associated with intermediaries but also eliminates the potential for errors or fraud that may occur in centralized systems.

Enhanced Data Integrity and Security

Blockchain technology enhances data integrity and security in financial systems by encrypting transaction data and storing it in a decentralized network of computers. This distributed ledger system ensures that data is secure from unauthorized access or manipulation, as changes to the data must be approved by consensus among network participants. This increased security and transparency make blockchain technology a valuable tool for improving the integrity of financial transactions and systems.